Get the free 50 246 form

Show details

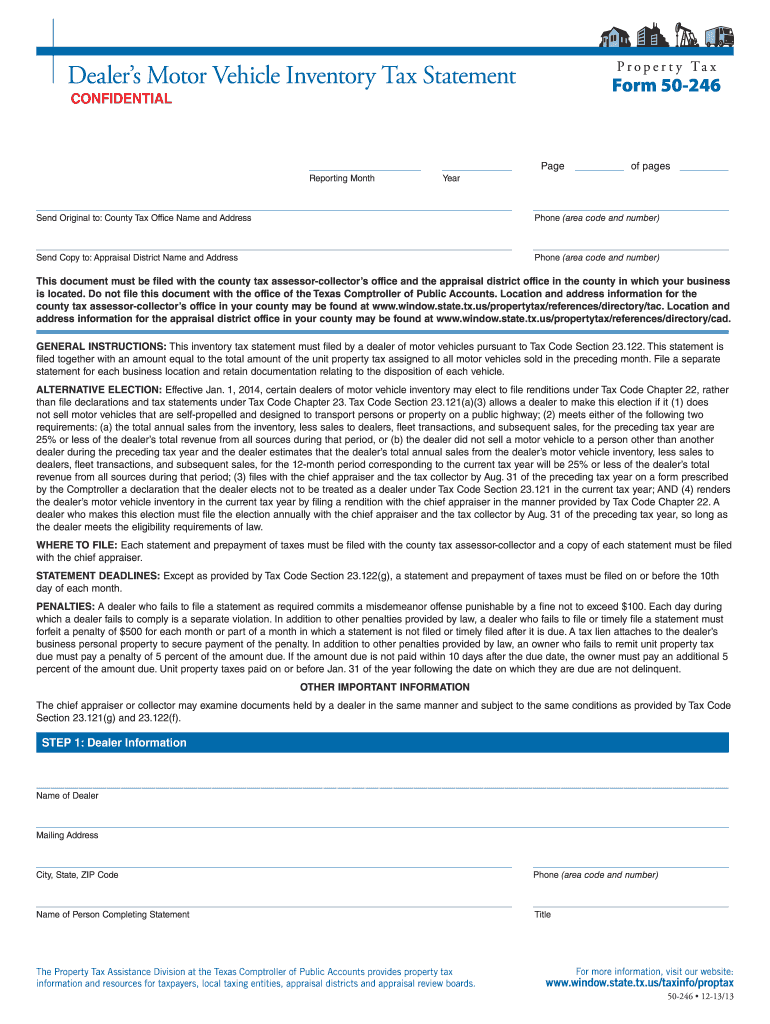

CONFIDENTIAL Dealer's Motor Vehicle Inventory Tax Statement Month and Year Form 50-246 See Page 3 for Instructions Page P r o p e r t y Ta x of pages Send Original with Payment to: County Tax Office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 50 246 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 50 246 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 50 246 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 50 246. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 50 246 form

How to fill out form 50 246:

01

Begin by obtaining a copy of form 50 246, which can typically be obtained from the relevant organization or institution.

02

Familiarize yourself with the instructions provided with the form to understand the purpose and requirements of each section.

03

Start by entering your personal information accurately and completely in the designated fields. This may include your full name, address, contact information, and any other requested details.

04

Follow the instructions on the form to provide any additional information or documents that may be required, such as identification documents or supporting evidence.

05

Double-check all the information you have entered to ensure its accuracy and completeness.

06

Sign and date the form in the appropriate section to confirm your agreement and authenticity of the provided information.

07

Make copies or keep a digital record of the filled-out form for your records.

Who needs form 50 246:

01

Individuals who are required to provide specific information according to the regulations or policies of the organization or institution that uses this form.

02

Applicants or individuals seeking to fulfill a specific requirement, such as applying for a license or permit, requesting a service, or initiating a process.

03

Anyone who is instructed to complete form 50 246 as part of a specific procedure or legal obligation.

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 50 246?

Form 50 246 is the Employee's Statement of Exemption from Withholding. This form is used by employees who wish to claim exemption from income tax withholding. Therefore, employees who meet the exemption criteria are required to file this form.

How to fill out form 50 246?

Form 50 246 is used to request a Certificate of Divorce or Annulment in Canada. Here are the steps to fill out the form:

1. Obtain the form: You can find Form 50 246 on the website of the Government of Canada or by visiting your local courthouse.

2. Read the instructions: The first section of the form provides important information. Read through it carefully to understand what is required.

3. Identity of the applicant: Fill in your personal information, including your full name, address, date of birth, and contact information.

4. Type of Application: Tick the appropriate box to indicate whether you are applying for a Certificate of Divorce or a Certificate of Annulment.

5. Court information: In this section, provide details about the court where your divorce or annulment was granted, including the name of the court and the location.

6. Date of Divorce/Annulment: Enter the date of your divorce or annulment. If you are unable to recall the exact date, mention an approximate one.

7. Additional information: If you have any additional information that may be helpful for the application, provide it in this section.

8. Signature: Sign and date the form to verify that the information provided is accurate and complete.

9. Submitting the form: Send the completed form to the appropriate authority. The mailing address details can usually be found on the form itself or on the government website.

Remember to double-check your form for accuracy and completeness before submitting it. If you have any doubts or questions, consider seeking assistance from a legal professional or contacting the relevant court for guidance.

What is the purpose of form 50 246?

Form 50 246 is a document used in the United States federal government. However, there is no specific form with this number provided by the Internal Revenue Service (IRS), Social Security Administration (SSA), or any other major federal agency. To determine the purpose of form 50 246, I would need more information about the agency or organization that issues it.

What information must be reported on form 50 246?

Form 50 246, also known as the Incident Report, typically requires the following information to be reported:

1. Date and time of the incident.

2. Location where the incident occurred.

3. Detailed description of the incident, including what happened and any contributing factors.

4. Identification of the individuals involved in the incident, such as names, positions, and employee numbers.

5. Contact information of the reporting party or person filling out the form.

6. Information regarding any witnesses to the incident, including their names and contact details.

7. Description of any injuries or damages resulting from the incident.

8. Actions taken to address the situation and prevent future incidents.

9. Signature and date of the person completing the form.

10. Any additional relevant information or comments related to the incident.

It is essential to note that the specific requirements for Form 50 246 may vary depending on the organization or agency using the form.

When is the deadline to file form 50 246 in 2023?

I apologize, but form "50 246" is not a recognized or widely used form that I am aware of. It is possible that you may be referring to a form specific to a certain organization or locality. To provide accurate information about the deadline, please provide more context or clarify the organization or context the form belongs to.

What is the penalty for the late filing of form 50 246?

Form 50 246 is specific to the Texas Comptroller of Public Accounts and is used to report late or unpaid sales and use taxes. The penalties for the late filing of this form can vary depending on the exact circumstances and the amount owed. However, generally, the penalties for late filing of sales and use taxes in Texas are as follows:

- 5% of the tax due for late filing, if the return is filed within one month after the due date.

- An additional 5% of the tax due for each additional month or part of a month that the return is late, up to a maximum penalty of 25%.

- If the Comptroller sends you a notice of late filing, an additional 5% penalty will be added on top of the existing penalties.

It's important to note that these penalties can accumulate over time, and there may be interest charges as well. It's always advisable to consult with a tax professional or contact the Texas Comptroller's Office for specific penalties related to the late filing of Form 50 246.

How do I complete 50 246 online?

Easy online form 50 246 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out texas form 50 246 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your dealers motor vehicle inventory tax statement form 50 246 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out 50 246 form on an Android device?

On Android, use the pdfFiller mobile app to finish your 50 246. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your 50 246 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Form 50 246 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.